Read the Road to Economic Recovery policy recommendations here.

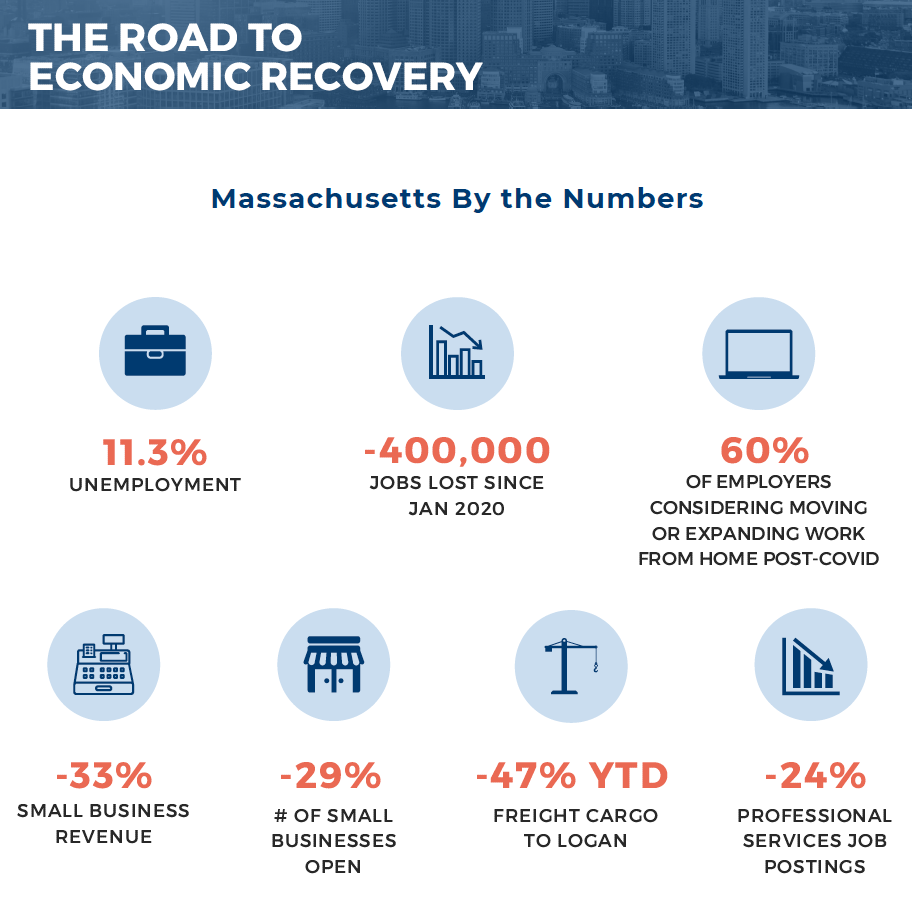

Massachusetts faces a stark economic picture that underscores the need for a strong recovery. Employment is worse than the Great Recession, there are job losses in every sector combined with fewer jobs being posted, small businesses are struggling, and less freight cargo is arriving at Logan Airport. Plus, there’s an existential threat to the state’s competitive advantage: the shift to remote work means that having talent in close proximity to business could become less important for both employers and employees.

When policymakers consider which steps to take to restore and strengthen our economy, the Chamber recommends using the following core principles.

Principles for The Road to Economic Recovery

- Avoid policies that damage or inhibit an economic recovery. Economic growth generates new state revenue organically, while a stagnant economy places ever-rising burdens on residents in the form of both spending reductions and tax increases. Supporting a strong economic recovery will benefit the residents of Massachusetts, employers, and the state budget.

- Recovery must provide equal opportunities across race, gender, income, and geography. Massachusetts can use this recovery to reduce inequality by ensuring that its policies embrace and support residents who were historically left out of the region’s economic growth.

- To close budget gaps, the burden must be shared. The state should balance controlling expenses, borrowing, and revenue in ways that support equitable economic growth. Revenue includes federal aid, stabilization fund, and tax amnesty. If federal funding becomes available, the state should be prepared to obtain maximum federal aid as soon as possible.

- Any revenue increase to close the budget gap should be temporary, simple, and based on the existing tax structure, with a share of the increase dedicated to stimulating economic development and growth. It should also be accompanied with other changes to ease the burden of doing business in Massachusetts, like unemployment reforms and liability protections, and relief for low-and moderate income individuals, such as increasing the EITC or expanding access to online training opportunities.

- Policymakers should review proposals in the context of existing burdens. These include but are not limited to:

- Unemployment Insurance: According to the Department of Unemployment Assistance’s August report, UI rate increases are projected to cost an average of $319 per employee in 2021 and an additional $55 in 2022.

- 2018 Ballot Measures: Paid family and medical leave is a major new mandated employer benefit and benefits begin on January 1, 2021. There will be costs for employers in the form of both premiums and replacement workers and lost productivity. Compounding the burden for small employers, a higher minimum wage also takes effect on January 1.

- State’s Contribution to Federal Revenues: The federal government has already authorized $3 trillion in coronavirus relief and that may increase. While the state can and should benefit from additional aid, the bill for federal spending will eventually come due. Since Massachusetts pays a disproportionate share of federal taxes – accounting for 3.4% of all gross IRS tax collections but only 2.1% of total US population in FY 2019 – when it comes to restoring federal finances, the burden will fall on Massachusetts employers and residents.